High-Yield Monthly Dividend Stocks

Apr 10, 2023 By Triston Martin

Dividend-paying stocks are a fantastic method to build wealth and earn passive income over time. Stocks that distribute stocks with high dividend yields typically do so quarterly or annually, although some can pay dividends regularly. Stocks that pay dividends monthly might provide investors with a reliable flow of money every month. In this post, we'll look at the upsides and downsides of investing in businesses that pay large monthly dividends. Companies with stable, predictable businesses are more likely to issue such stocks since they are in a better position to transfer earnings to shareholders regularly. Also covered will be the pros (compounding, diversity, and predictability) and cons (volatility, yield traps) of investing in equities that pay monthly dividends.

How do Monthly Dividend Stocks work?

Stocks of firms that pay monthly dividends are called "monthly dividend stocks." These businesses can afford to pay their earnings more often to their shareholders since they operate in secure markets with reliable cash flows. Stocks that pay dividends monthly might provide investors with a reliable flow of money every month.

Advantages of Stocks with Monthly Dividends

Buying equities that pay dividends every month has several advantages. Some of the main benefits are as follows:

- Regular dividend payments from monthly dividend stocks may be a welcome boon for retirees or other investors who depend on their assets for income.

- Passive Income: Investors may earn passive income from monthly dividend stocks without actively managing their portfolios.

- The power of compounding may be harnessed by investors via the reinvestment of stocks with high dividend yields 2023 regularly.

- Investors might profit from diversification when they purchase monthly dividend stocks since these firms often belong to diverse businesses and sectors.

- Monthly dividend stocks are stable investments since their issuing corporations have a history of regular profits.

Monthly Dividend Stocks Risks

Even with the attractiveness of monthly dividend stocks, investors should be mindful of their potential drawbacks. The most significant ones are as follows:

- Stocks that pay monthly dividends are volatile because of the company's financial performance. The resulting drop in stock price may impact the investor's earnings potential.

- Dividend yield traps: some organizations advertise attractive dividend yields to attract investors. Avoiding a yield trap is a must for investors.

- Interest Rates: If interest rates rise or fall, monthly dividend stocks may become less or more appealing. Investors may move their money into higher-yielding fixed-income products if interest rates climb.

- Investments in monthly dividend equities from a single sector may raise portfolio risk since the portfolio's performance may be correlated with that sector's performance.

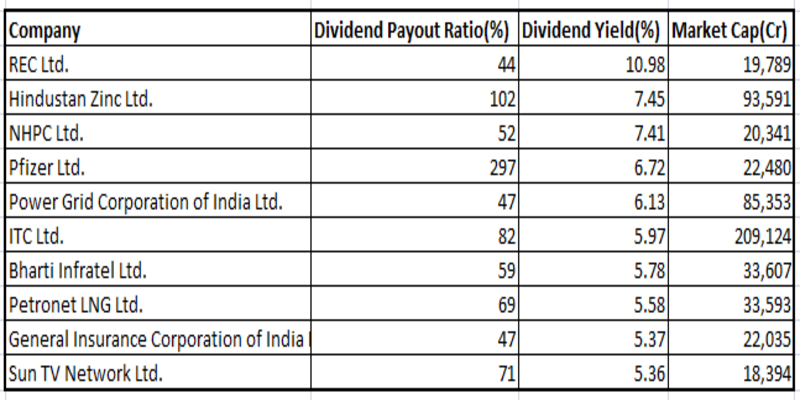

High-Yielding Monthly Dividend Stocks

High-yielding equities that pay monthly dividends are listed below.

- AGNC Investment Corp (AGNC) is a mortgage-backed securities real estate investment trust (REIT). The dividend is paid monthly, and the yield is around 8.5 percent.

- Global Net Lease, Inc. (GNL) is a commercial real estate investment and management firm. The dividend is paid monthly, and the yield is around 9.5 percent.

- Canadian energy infrastructure operator Pembina Pipeline Corp (PBA) owns and operates pipelines and other midstream assets. The monthly safest dividend stocks with high yields from this firm now yields somewhere about 6%.

- The Realty Income Corporation (O) is a retail-focused real estate investment trust (REIT). The dividend is paid monthly, and the yield is around 4.5 percent.

- STAG Industrial Inc. (STAG) is a commercial real estate firm managing industrial facilities. The dividend is paid monthly, and the yield is around 5.5%.

- Canadian provider of high-speed internet, cable television, and telephone services Shaw Communications Inc. (SJR). The monthly dividend from this firm now yields somewhere about 4%.

- The Main Street Capital Corporation (MAIN) is an SMB-focused business development corporation. The monthly dividend from this firm now yields somewhere about 6%.

- PSEC, or Prospect Capital Corporation, is a BDC that helps small and medium-sized enterprises get the money they need to grow. The dividend is paid monthly, and the yield is around 7%.

Conclusion

High-yield monthly dividend stocks may be a fantastic strategy to diversify your portfolio and earn passive income. Investors should do their homework and be aware of the dangers (such as volatility and yield traps) before making any choices. Remember that dividends are not a given and that firms might choose to reduce or eliminate them at any moment. Research and talk to a financial professional before making any investment, as you should with any investment.

Triston Martin Aug 30, 2022

Best Banking Books 2022

25224

Susan Kelly Oct 14, 2022

The 5 Essentials of an Estate Plan

92744

Triston Martin Apr 10, 2023

High-Yield Monthly Dividend Stocks

65217

Susan Kelly Apr 27, 2023

Best Place to Buy Used Furniture Estate Sales

19675

Triston Martin Sep 26, 2022

Ways to Maximize Travel Credit Card Rewards

13438

Susan Kelly Apr 28, 2023

How to Find a Financial Advisor if You're Not Rich

1683

Susan Kelly Aug 23, 2022

Insurance Companies vs. Banks: Comparing and Differentiating

97350

Triston Martin Aug 30, 2022

Quantitative Analysis of Hedge Funds

34710