Ways to Maximize Travel Credit Card Rewards

Sep 26, 2022 By Triston Martin

However, accumulating points and miles and redeeming them may be challenging, and maximizing your card's benefits isn't always evident. You shouldn't worry about it even if you aren't an expert since we've got your back. Here is how to get the most out of the travel perks that come with your credit card.

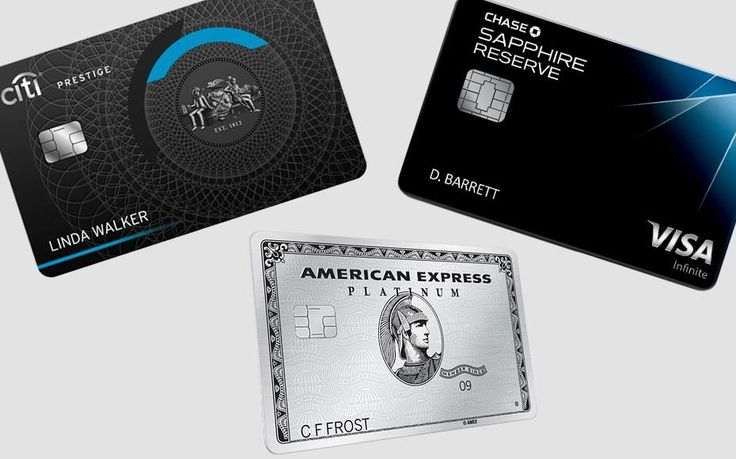

Make Sure You Have the Right Cards

To begin with, the most important: Check that the credit cards in your wallet can accommodate your preferred methods of payment and travel options. You are not making smart use of travel credit cards if you need to make significant adjustments to how you purchase and travel to accumulate rewards. Make use of what is successful for you. A branded travel card might benefit you if you strongly agree with a certain airline or hotel operator. You might, for instance, collect a significant number of miles on American Airlines trips with the assistance of a Citi AAdvantage Platinum Select World Elite Mastercard, which would allow you to exchange those points for other tickets on American Airlines subsequently.

Use Travel Cards for Everyday Expenses

If you solely use travel credit cards to pay for travel expenditures, you are passing up a lot of possibilities to earn rewards for using such cards. Many credit cards provide bonus points or miles for spending in areas other than travel, such as groceries, eating out, petrol, or other purchases. Taking advantage of these incentives will allow you to accumulate travel points quickly.

Look for Bonus Earning Opportunities

When you initially receive a travel credit card, many companies give bonus miles or points for spending a certain amount during the first few months of having the card. However, even after that, there are often additional opportunities to earn bonus points or discounts on certain purchases via various unique promotions.

Certain deals are only available for a short time, while others are tied to the amount of money you charge on your card, the way you use your points or the places you go. You may, for instance, get a good bargain on a package for a family trip, receive more points for shopping for back-to-school items or get a significant bonus for spending $25,000 in a calendar year. After doing in-depth research on the value of hotel points and airline miles, the team at The Balance concluded that redeeming travel rewards for non-travel-related purchases, such as gift cards or items from Amazon, is not always the best use of one's points or miles. According to the findings of our investigation, redeeming travel rewards in this manner may reduce their worth by as much as three quarters.

Don't Book Travel Through a Third Party

Even if your credit card gives you bonus points or miles for money spent on travel, you shouldn't assume that this applies to all of your transactions with the same hotel or airline. Many credit cards incentivize customers to remain loyal by limiting access to the greatest rewards earning rate to situations in which they make travel expenditures via their dedicated rewards portal or directly with the card issuer. If you book your trip via a website operated by a third party, such as Kayak or Expedia, or a travel agent, you will most likely not accumulate as many points or miles as you would otherwise.

Read Reward Category Terms

Before making any purchases, it is important to look through the rules of the reward categories associated with your credit card. The retailer will categorize your transaction, and the number of miles you earn will be determined based on whether or not your card rewards certain purchase codes. For instance, if your card awards you double points whenever you purchase in a grocery store, you won't immediately be awarded double points if you purchase milk or bread. You would be out of luck if you acquired them from a retail or convenience shop that does not consider your transaction to be a purchase of groceries.

Don't Pay for Benefits You Don't Use

Travel cards with yearly fees generally have additional high-value features, such as free admission to airport lounges or a waiver on the expenses associated with checked bags. If you don't try to utilize the perks that come with your card, the money you save by paying the annual fee will be wasted. Close your travel card account if you cannot make sufficient use of the advantages offered by the card to offset the yearly charge. Choose a card that is less complicated and has no extra fees attached to it.

Add Authorized Users

It would help if you gave some thought to adding authorized users to your account since some credit cards provide these individuals access to perks associated with travel, such as complimentary usage of airport lounges. You and your traveling companions can take advantage of some of the same perks at no extra expense, bringing you one step closer to recouping the cost of the yearly membership fee.

Triston Martin Jun 01, 2023

Teaching Your Teenager About Money: A Guide To Financial Success

51777

Triston Martin Apr 02, 2023

IRA withdrawal rules

30026

Susan Kelly Aug 25, 2022

Different Features of Tier 1 Capital Ratio

97415

Triston Martin Sep 01, 2022

Target Prices: The Secret To Successful Investing

76297

Susan Kelly Aug 28, 2022

Ways ROA and ROE Give a Clear Picture of Corporate Health

72788

Triston Martin Sep 01, 2022

How Businesses Determine Their Total Revenue

72793

Susan Kelly Oct 21, 2023

Financial Struggles: Why Even High Earners Struggle with Cash Flow

32762

Triston Martin Dec 04, 2022

How to Look for Insurance Company Complaints

55247