Different Features of Tier 1 Capital Ratio

Aug 25, 2022 By Susan Kelly

The connection between a financial institution's core capital and its total assets is referred to as the tier 1 leverage ratio. This results in a percentage value. For instance, the cash a bank has on hand and the government securities it holds would each get a weighting of 0%, but the bank's mortgage loans would be awarded a value of 50%.

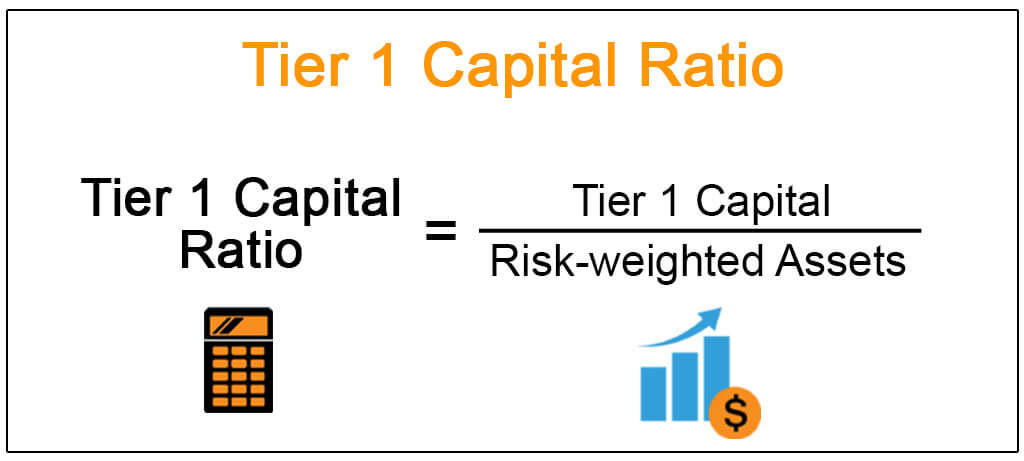

Tier 1 Capital Ratio

The worldwide capital and liquidity regulations developed by Basel III in 2010 in the wake of the global financial crisis use the tier 1 capital ratio as its foundation. The financial crisis revealed that many banks had insufficient capital to absorb losses or maintain their liquidity. However, unlike the tier 1 capital ratio, the tier 1 leverage ratio does not use risk-weighted assets in the denominator. They were supported with an excessive amount of debt and an insufficient amount of equity.

Basel III standards will restrict both tier 1 capital and risk-weighted assets, with the goal of compelling financial institutions to enhance their capital buffers and ensuring that they can weather periods of financial turmoil without going bankrupt. At least 4.5% of RWAs be included in the equity portion of tier-1 capital. It is required that the percentage of tier 1 capital be at least 6%. The tier 1 leverage ratio is a tool used by central monetary authorities, much like the tier 1 capital ratio. Additionally, Basel III mandated the implementation of a minimum leverage ratio, which must be at least 3% of a bank's total assets to qualify for tier 1 capital, and even higher for globally systemically significant institutions deemed "too large to fail."

Risk

Central banks often develop the weighting scale for various asset types. Cash and government securities carry no risk, but a house loan or automobile loan would carry a higher risk. Inversely proportional to an asset's degree of credit risk, its weight in the risk-weighted asset portfolio would increase. The weight assigned to cash would be 0%, while the weights assigned to loans of increasing credit risk would range from 20% to 50% to 100%.

There is little distinction between the tier 1 capital ratio and the tier 1 common capital ratio. The total amount of a bank's equity capital reported reserves and preferred stock that is non-redeemable and does not accumulate is considered to be its Tier 1 capital. However, Tier 1 common capital does not include any preferred stock and does not take into account any non-controlling interests. The company's common stock retained profits and other comprehensive income is all components of the firm's Tier 1 common capital.

Example of the Tier 1 Capital Ratio

For this example, let us suppose that the shareholders' equity of bank ABC is $3 million and that it has retained profits of $2 million, giving it a total of $5 million in tier 1 capital. Bank ABC holds a risk-weighted asset total of $50 million. As a result, it is seen as being adequately capitalized compared to the prerequisite minimum.

On the other hand, bank DEF has shareholders' equity of $400,000 and retained earnings of $600,000. As a result, its level 1 capital is one million dollars. Bank DEF has risk-weighted assets totaling the amount of $25 million. This means that the bank is undercapitalized. The risk-weighted assets of Bank GHI come in at $83.33 million, while its tier 1 capital sits at $5 million. They were supported with an excessive amount of debt and an insufficient amount of equity. Consequently, the tier 1 capital ratio for bank GHI is 6% ($5 million divided by $83.33 million), which is considered appropriately capitalized given that it is equivalent to the minimal tier 1 capital ratio.

Difference between the Tier 1 Capital and Tier 1 Leverage Ratio

The connection between a financial institution's core capital and its total assets is referred to as the tier 1 leverage ratio. This results in a percentage value. The tier 1 leverage ratio is a tool used by central monetary authorities, much like the tier 1 capital ratio. There is little distinction between the tier 1 capital ratio and the tier 1 common capital ratio. The total amount of a bank's equity capital reported reserves and preferred stock that is non-redeemable. Cash and government securities carry no risk, but a house loan or automobile loan would carry a higher risk. Inversely proportional to an asset's degree of credit risk, its weight in the risk-weighted asset portfolio would increase. However, unlike the tier 1 capital ratio, the tier 1 leverage ratio does not use risk-weighted assets in the denominator.

Triston Martin Sep 01, 2022

Target Prices: The Secret To Successful Investing

23669

Susan Kelly Jun 03, 2023

How to Retire in Canada: A Complete Guide

11451

Susan Kelly Aug 17, 2022

Best Health Insurance for College Students To Choose From

98149

Susan Kelly Nov 09, 2023

Detailed Guide on How to Transfer American Express Points to Delta

83782

Triston Martin Oct 02, 2022

Everything You Need to Know About the Best Passive Investing Strategy

90040

Susan Kelly Aug 25, 2022

Different Features of Tier 1 Capital Ratio

21281

Triston Martin Jun 07, 2023

What Is a Contribution Deferral in a 401(k) Plan?

65813

Triston Martin Oct 30, 2022

Which Mutual Funds Are The Safest And Most Reliable?

9126